Every year, millions of Americans utilize the convenience of online shopping, resulting in a more than $200 billion industry.

While convenient, online shopping impacts our local brick and mortar stores since online retailers – unless they have a facility located in Indiana – do not have to collect Indiana sales tax. Senate Bill 545 looks to correct this issue and put online and brick and mortar stores back on the same playing field.

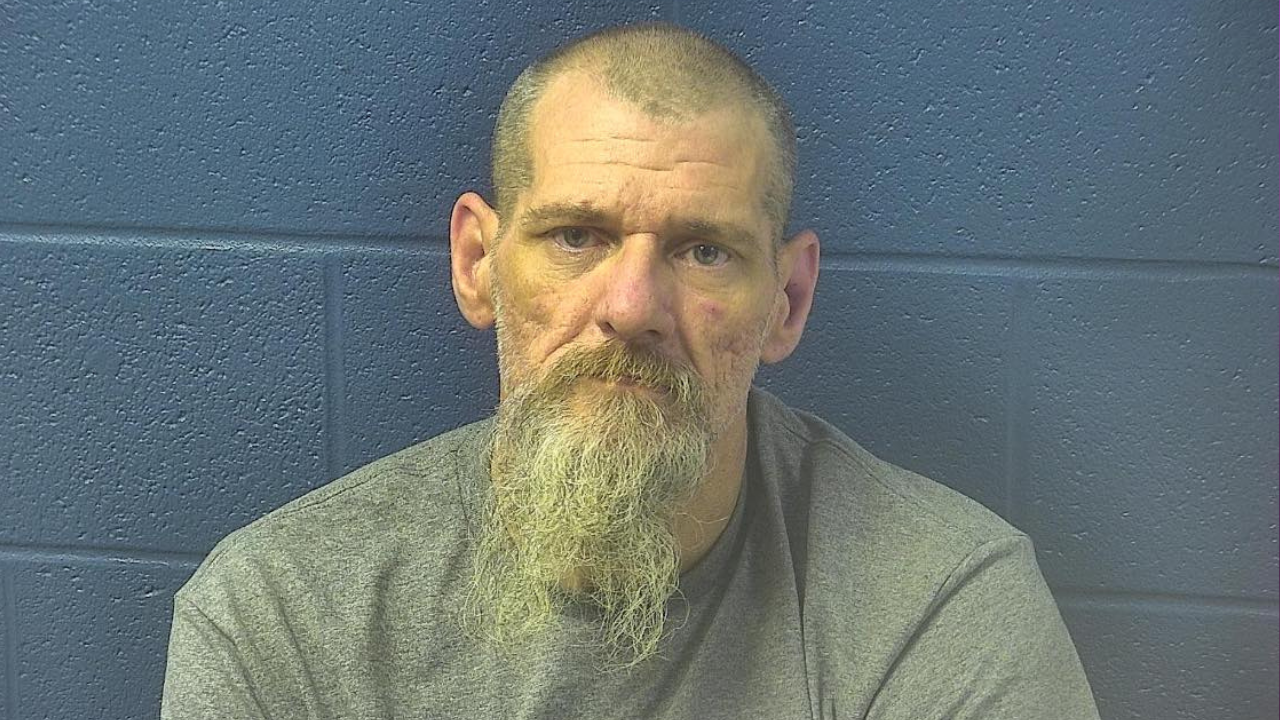

District 48 State Senator Mark Messmer of Jasper says under Senate Bill 545, companies that sell at least $100,000 of product or have 200 separate retail transactions per year in Indiana would now be required to collect our state sales tax…

Messmer says regardless of how much money is lost, the discrepancy puts brick and mortar stores at a disadvantage, since they have to collect the tax. He says our tax system is at it’s strongest when it is fair to everyone, and this bill is a step in the right direction, making our system more equitable for these retailers.

The bill passed the Senate last week by a vote of 42-1. It will now move on to the House of Representatives for further consideration.

To continue to stay up to date on the progress of this bill as it moves through the House, please visit www.in.gov/iga.

You can contact Messmer’s office directly with your questions and concerns by email at Senator.Messmer@iga.in.gov or by phone at 800-382-9467.