The Indiana Department of Revenue (DOR), along with the IRS, will start accepting filings for 2025 Individual Income tax returns on Monday, Jan. 26, 2026. Unless you are filing an extension, the deadline to file state and federal income tax returns and pay any taxes that are due is Wednesday, April 15, 2026.

DOR urges taxpayers not to file their state tax returns prior to Jan. 26 or before obtaining all required documents. Tax return submissions without proper documentation can result in processing and refund delays. Employers must provide wage statements by Jan. 31.

Taxpayers who file an extension must remember that the extension is for filing only and does not extend the deadline to pay the tax that is due.

DOR encourages taxpayers to use electronic filing, online payments, and direct deposit for faster processing and refunds.

Eligible taxpayers may be able to utilize electronic filing using DOR-approved online tax vendors through the INfreefile program available at www.in.gov/dor/i-am-a/individual/infreefile/.

Additional information on Individual Income taxes, including extensions, late filings, and frequently asked questions, documentation required to file, and filing and payment options, is available at in.gov/dor/i-am-a/individual/.

Taxpayers who wish to contact DOR should use INTIME’s direct messaging feature at intime.dor.in.gov for the most efficient service.

Latest News

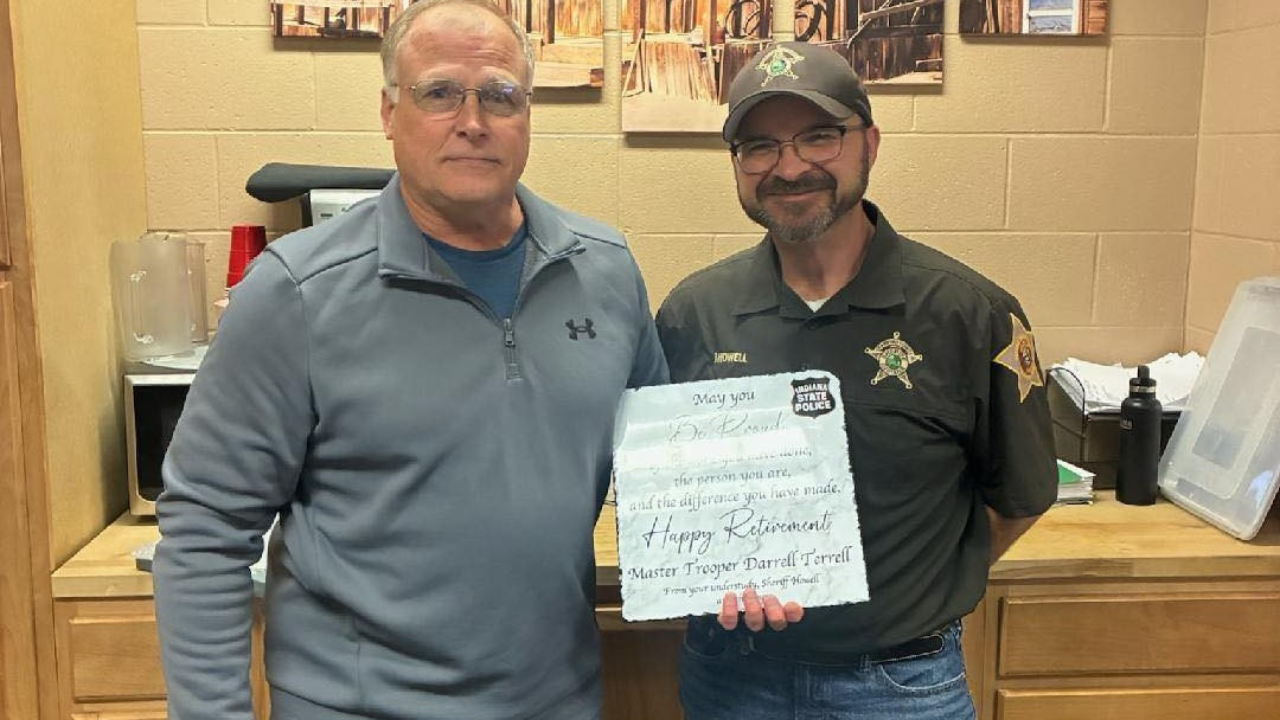

Crawford County Honors Master Trooper Darryl Terrell on Retirement

Two Arrested on OWI Charges in Separate ISP Jasper Post Stops

Avian Flu Confirmed at Crawford County Egg Farm

Multiple Orange County Weed Wrangles Scheduled for April

March Blood Donors Receive Amazon Gift Cards and Free Diabetes Testing From Red Cross

You must be logged in to post a comment.